Airbnb: A New Category of Travel

Airbnb is a leading global travel marketplace that provides private and alternative accommodations. Airbnb is an online platform where hosts offer guests stays and experiences. For guests, Airbnb provides affordable lodging and experiences. For hosts, Airbnb is a way to earn extra income. Airbnb has more than 4 million hosts and 5.6 million active listings of homes and experiences. Airbnb offers guests the opportunity to rent out entire homes, private rooms, luxury villas, cabins, treehouses, igloos, boats, castles, lighthouses, farms, and private islands, from one night to several months at a time, in 100,000 cities across 220 countries and regions.

How It All Started

Airbnb created a new category of travel.

In 2007, Airbnb co-founders Brian Chesky and Joe Gebbia needed money to pay their rent in San Francisco. An international design conference was coming to town, but hotels were sold out. Brian and Joe viewed this as an opportunity to launch Airbed & Breakfast. The website invited guests attending the conference to stay on airbeds in their apartment for $80 a night—breakfast included. After the first weekend of hosting people on their airbeds, Brian and Joe started to receive emails from people asking when Airbed & Breakfast would be available in places like Buenos Aires, London, and Japan. In 2008, former roommate Nathan Blecharczyk joined Brian and Joe as the third co-founder, and together they launched Airbnb.

Since Airbnb’s founding, hosts have welcomed 825 million guest arrivals and cumulatively earned over $110 billion.

Airbnb Disrupts Hotels

We believe Airbnb is best positioned to serve a large global travel and experiences economy that is increasingly shifting to alternative accommodations. Alternative accommodations as a share of total lodging have increased from ~6% to ~11% over the past decade; with the segment growing at a rate of ~9% as compared to ~4% of the broader market. The alternative accommodations product is still new for both consumers that use it and the network of property owners and managers that provide it. The traditional hotel that many of us have stayed at will always exist in our view—but we expect alternative accommodations like Airbnb to evolve over time. We think value-add services that closely resemble traditional hotels and online travel agencies (OTAs) such as flights, car rentals, and loyalty programs will accelerate the long-term secular shift to private and alternative accommodations.

Airbnb’s serviceable addressable market—a measure of total potential business in core markets—is worth $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for experiences (ex-casinos). Airbnb entered the experiences category to provide travelers access to private tours, cooking classes, wine tastings, and other unique activities like meditating with Buddhist monks and swimming with dolphins. Airbnb’s total addressable market—a measure of total potential business in current and future core markets—is worth $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences. We see a long runway for growth as Airbnb currently addresses ~3% of the market.

Consumer behaviors have dramatically changed over the past year (i.e., avoiding crowded hotel districts and frequently visited landmarks) because of the Covid-19 pandemic. These changes in consumer habits favor private and alternative accommodations as many consumers try the category for the first time. Are these changes in consumer preferences sustainable? A survey conducted by Raymond James indicated 41% of travelers are more likely to book at hotel alternatives over the next year due to Covid-19. Seventy-eight percent of travelers indicated they would book more through alternative accommodation sites like Airbnb in the future. Covid-19 has inspired new ways of experiencing travel that supports Airbnb’s business. We think Airbnb will benefit from its complementary and substitutive role in disrupting the old guard (i.e., the traditional hotel).

Low Hanging Fruit

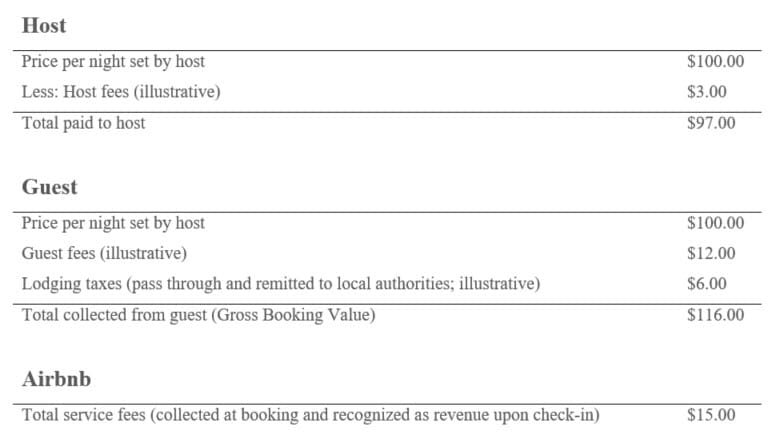

Airbnb generates revenue by facilitating transactions between hosts and guests. Individual hosts make up 90% of Airbnb’s host community. The other 10% are professional hosts such as professional property managers, service apartments, and boutique hoteliers. Airbnb charges individual hosts a service fee of 3% for each booking (15% for professional hosts, which is in-line with competitors). Airbnb charges the guest 12%—for an average service fee or “take rate” of ~15% for each booking. Traditional operators like Booking.com levy the entire 15% service fee on the host. Airbnb recognizes revenue upon check-in for a stay or experience from service fees charged to hosts and guests.

The table below shows an illustrative night booked on Airbnb.

Airbnb’s opportunity is not limited to private and alternative accommodations. We expect adjacent value-added services to emerge over time on Airbnb’s marketplace, including other travel modalities (i.e., flights, car rentals, traditional hotels), financial services (i.e., payment processing), loyalty-rewards programs, and advertising. In our view, these are inevitable revenue streams or “low hanging fruit” that Airbnb can explore to increase marketplace monetization and expand the total addressable market.

We think Airbnb has an opportunity to launch advertising tools for hosts. As marketplaces scale and go global, there is less certainty that potential buyers will see a merchant’s inventory. Marketplaces like Facebook, Amazon, and eBay have digital advertising tools available to drive product awareness and increase a merchant’s customer base. Airbnb does not offer digital advertising tools to hosts, but we see this as an inevitable high margin revenue stream in the future. To measure how large Airbnb’s advertising business could be at scale, we look to marketplace operators like Amazon, which have scaled this offering to ~3% of gross bookings. Using ~3% of Airbnb’s 2019 gross bookings, advertising could be a $1 billion business.

If we look to financial services, we think Airbnb has the option to pass payment-processing costs on to the host. Airbnb currently acts as the merchant of record and bears all payment processing costs associated with each booking. This is atypical when compared to other travel operators like Expedia’s Vrbo that charges hosts 5% of the booking and a 3% payment-processing fee. We see payment processing as an opportunity for Airbnb to collect a higher take rate.

Airbnb’s brand is widely known—and like Google and Uber, it has become a noun and verb in pop culture. Airbnb’s strong brand awareness has greatly reduced customer acquisition costs. More than 90% of all traffic to Airbnb’s platform comes from organic search and unpaid channels. About 79% of hosts and 77% of guests joined Airbnb organically in 2019. The brand resonates with hosts and guests, ultimately leading to powerful two-sided network effects and repeat bookings. In fact, stays from repeat guests made up ~70% of Airbnb’s revenue in 2019, up from ~62% in 2017 and ~52% in 2015. We think a customer loyalty-rewards program is an inevitable opportunity for the company to be more competitive against hotels and other OTAs, as well as to maintain high customer engagement with the platform.

Bundling your Airbnb stay with a car rental and flight is another “low hanging fruit” growth opportunity that can be explored.

A Positive Outlook

The travel industry experienced sharp declines in bookings in 2020. But unlike many of its competitors, Airbnb’s gross bookings began to recover in May 2020. Airbnb gross bookings for domestic travel (within the same country), short-distance travel (under 500 miles) and long-term stays (28 nights or more) were resilient, with year-over-year growth, offsetting weakness in international travel. We are seeing airline passenger traffic and lodging trends accelerating with the easing of international travel restrictions and the opening of borders to travelers. TSA’s average daily volume for screening is currently ~70% of pre-pandemic levels and increasing each day. We expect travel and hotel bookings to inflect strongly in the near-term as cross-border travel picks up.

Travel will come back, and Airbnb is a prime beneficiary of the return.

We have a positive outlook on Airbnb for several reasons. The travel market is increasingly moving away from traditional hotels to private and alternative accommodations. Airbnb is the category leader, with the largest supply base, and gross bookings ~2x the size of Booking.com’s alternative accommodations business, and ~3x the size of Expedia’s Vrbo. Airbnb expects to generate durable double-digit revenue growth and get to more than 30% EBITDA margins over time. We believe Airbnb can achieve 30% margins through fixed and variable cost leverage (i.e., reduce performance marketing). Future monetization opportunities such as loyalty-rewards programs and sponsored listings could provide many years of revenue and profit growth.

We continue to view Airbnb as a core holding in client portfolios.

Risk factors include 1) greater competition from hotels and other travel marketplaces, 2) slower-than-expected shift to alternative accommodations, 3) macroeconomic uncertainty, 4) regulatory risks, and 5) prolonged impacts from the Covid-19 pandemic.

Sources

- Airbnb S-1 [LINK]

- Credit Suisse. Airbnb: Category Creator and Leader, Driving Substitution Effect in Lodging. January 4, 2021.

- Raymond James. Airbnb: Initiating Coverage with Market Perform Rating. January 4, 2021.

- Wall Street Journal. Airbnb, Vrbo Battle for More Vacation Cabins as Travel Rebounds. June 17, 2021. [LINK]

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Christopher De Sousa, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.