Thermo Fisher Scientific: A Global Leader In Life Science Tools

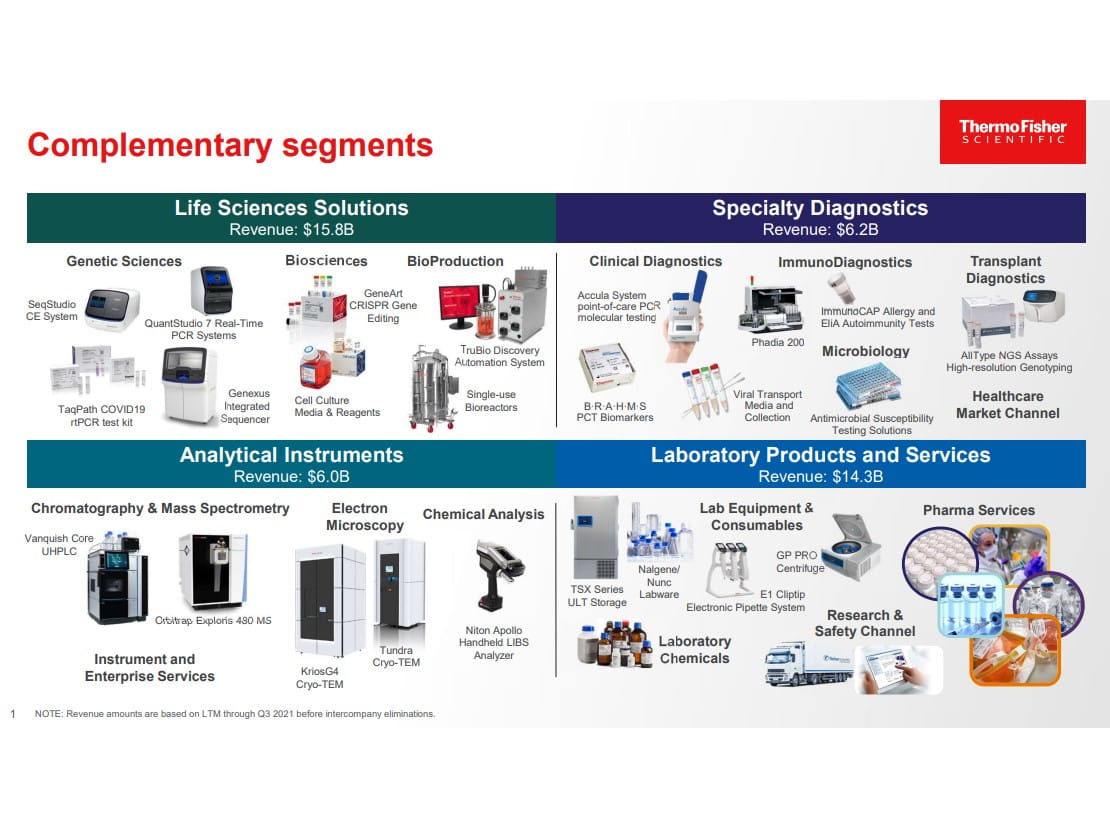

Thermo Fisher Scientific is a leading global manufacturer and distributor of analytical instruments, lab equipment, consumables, and value-added services (e.g., drug development, clinical trials, and contract manufacturing) in the life science tools and diagnostics industry. Thermo Fisher supplies the “picks and shovels” to a large and growing installed base of researchers, scientists, and engineers in the biopharma, clinical diagnostics, government, academic, industrial, and applied end markets. Thermo Fisher acts as a one-stop-shop for a customer’s entire workflow, from lab supplies to services (e.g., running clinical trials and manufacturing drugs on behalf of biopharma companies).

The underlying business model is resilient and is built to capitalize on growth opportunities, such as robust R&D funding in the life sciences market (~$200 billion annually) and greater demand for novel biologics, vaccines, and cancer therapies. Moreover, we expect Thermo Fisher to augment growth with M&A in a highly fragmented life sciences industry. Since 2010, Thermo Fisher has completed over 50 transactions valued at more than $30 billion, with a focus on expanding the breadth of its product and service solutions. Long-term, Thermo Fisher expects organic revenue growth to be 7% to 9% and earnings per share (EPS) growth to be 14% to 15% on an annualized basis.

We view Thermo Fisher Scientific as a core long-term holding that possesses qualities of a competitive moat that is widening in the life science tools and diagnostics industry.

Note: This write-up will focus mainly on Thermo Fisher’s large and fast-growing pharma and biotech end market.

Business Overview

Thermo Fisher is a leading provider of analytical instruments, lab equipment, and consumables (e.g., biochemical reagents, vials, containers, petri dishes, pipette tips, diagnostic test kits, etc.) to highly regulated end markets. In the biopharma end market, medical researchers and scientists are required to provide detailed specifications of the lab equipment and consumables used in their workflows. Thermo Fisher is providing essential components such as biological reagents and lab instruments in each step across the workflow to design and manufacturer medicines and therapies. Importantly, when a biopharmaceutical company submits the drug for regulatory approval, the components used to develop and manufacture the drug are part of the regulatory filing.

Thermo Fisher is deeply embedded throughout the life cycle of a drug. Strict regulatory oversight creates very sticky and long-term customer relationships. Once an instrument is specified into the design (e.g., drug development and manufacturing process), the cost of switching out that instrument is significant. The biopharmaceutical company would have to find a new partner and revisit the regulatory environment (requires submitting the new specifications to the FDA and the FDA would have to reauthorize the facility/process, which can take months or even have to reauthorize the drug). All of this is timely and expensive for biopharmaceuticals. The regulatory requirement for consistency in performance and measurement results in high switching costs, as well as high barriers to entry for competitors—two factors contributing to Thermo Fisher’s competitive advantage in the life science tools and diagnostics marketplace.

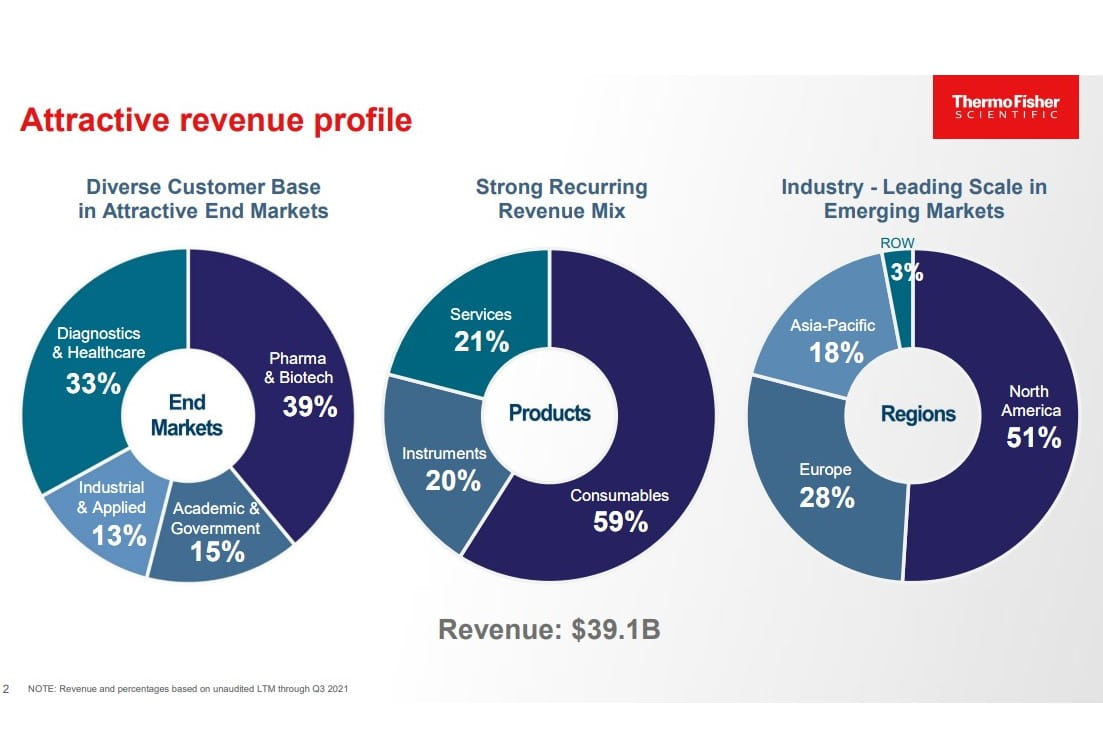

Drug discovery and development is a complex and iterative process. The instruments used to measure, analyze, and produce biological data require a recurring flow of single-use consumables. Some instruments typically form a closed system. This means the instrument will only operate by using their own branded consumables. For example, if a medical researcher is using one of Thermo Fisher’s bioprocessing centrifuges (to separate particles in a liquid, like blood cells), then they can only use the bioprocess containers developed specifically for that machine to reduce cross-contamination risk. This razor-and-blade business model generates an attractive base of recurring revenue from selling high-margin consumables for instruments that tend to have an average life of 5 to 12 years (i.e., locking in the customer for many years). Thermo Fisher’s revenue mix is approximately 80% recurring, due largely from the sales of consumables and services.

Thermo Fisher enjoys a high level of pricing power from selling critical instruments and consumables that represent a relatively small portion of a customers’ overall R&D budget. This has allowed Thermo Fisher to steadily increase prices from 0.50% to 1% each year. Over time, we expect Thermo Fisher to increase its share of wallet at existing customers by launching relevant products and services. Thermo Fisher plays a meaningful role as a supplier, but also, a trusted advisor in the development of vaccines and therapies. Thermo Fisher touches the customer across the entire value chain from early discovery and research to clinical trials and contract development and manufacturing. In our view, the customer value proposition is unmatched in the life science industry.

Build and Buy Strategy

Thermo Fisher talks to C-suite executives and heads of R&D each day to identify what they need to accelerate advances in medical research and bring novel medicines to market. Importantly, those conversations help pin-point gaps in the company’s product and service offerings (e.g., contract research) and opportunities to expand into adjacent/vertical markets (e.g., gene/cell therapy). Thermo Fisher will often internally develop a new product or technology. But in some cases, it will acquire a business to gain access to a specific product set or adjacent/vertical market to further strengthen its customer value proposition. Thermo Fisher takes a disciplined approach to M&A. An acquisition of a product or service needs to be clearly valued by its customer base, but also improve the company strategically. Return on invested capital or ROIC governs every decision made by the company—not just acquisitions, but internal investments such as R&D and capital spending. M&A must clearly create shareholder value as measured by ROIC.

The life science tools market is a $170 billion global opportunity that is expected to grow +4-6% annually. Thermo Fisher and two other players represent 35% of the broader market (of which Thermo Fisher holds 15% market share). Key growth drives include favourable demographic trends, scientific advances in life science research, rising demand for biologics, and robust R&D funding in biotech. Thermo Fisher plays the role as a leading consolidator in the highly fragmented life science tools market. Since 2010, Thermo Fisher has completed over 50 transactions valued at more than $30 billion, with a focus on expanding its depth and breadth of capabilities, and expertise in fast-growing markets such as biopharma. M&A is ingrained in the company’s DNA. Thermo Fisher was formed by the 2006 merger of Thermo Electron (founded in 1956) and Fisher Scientific (founded in 1906). The merger was valued at ~$10 billion at the time and created one of the largest and most diversified life science tools companies.

Over the past five years, Thermo Fisher’s M&A playbook has focused on acquiring highly complementary services offerings.

In 2017, Thermo Fisher acquired Patheon to enter the contract development and manufacturing market. Patheon is the second largest global contract development and manufacturing organization or CDMO that provides comprehensive services from development to manufacturing of biologics and drug products. Patheon serves a ~$120 billion CDMO industry that is forecasted to grow +6-7% annually and remains to be highly fragmented and underpenetrated. Biopharma companies are increasingly opting to outsource drug development and manufacturing processes to CDMOs. The current market penetration is ~30% (percentage of manufacturing outsourced), but we expect this to increase as biopharma companies are moving toward asset-light models and concentrating on core competencies.

Adding to its CDMO capabilities, Thermo Fisher acquired Brammer Bio (2019) and Henogen (2021) to broaden its viral vector manufacturing capabilities for gene/cell vaccines and therapies. Viral vectors are used to deliver genes to cells in gene therapy.

Furthermore, Thermo Fisher is in the process of acquiring Pharmaceutical Product Development (PPD), a leading global contract research organization or CRO managing clinical trials and research in the pharma and biotech industry. CROs provide key services in drug development (e.g., Phase 1 through Phase 3 clinical trials), including study design, trial management, patient recruitment, and clinical lab services. PPD serves a ~$50 billion clinical research services industry that is forecasted to grow in the mid-single digits annually. Like CDMOs, the CRO industry growth is fueled by biopharma companies increasingly outsourcing clinical trial management (~60% outsourced today) to global CROs like Thermo Fisher/PPD that can quickly enroll trials.

All in, Thermo Fisher can provide a full CDMO-CRO offering (pending PPD) to biopharma customers as they move from drug discovery to an FDA approved medicine. More pharmaceutical customers are looking to consolidate their contracts to fewer trusted partners to drive speed and efficiency in their supply chains. We think Thermo Fisher will be a key beneficiary of outsourcing trends and contract consolidation in the long-term. Thermo Fisher’s end-to-end service offerings, as well as the capability of providing analytical instruments and consumables across the biopharma workflow puts the company into an attractive position to win greater market share.

Attractive Growth Story

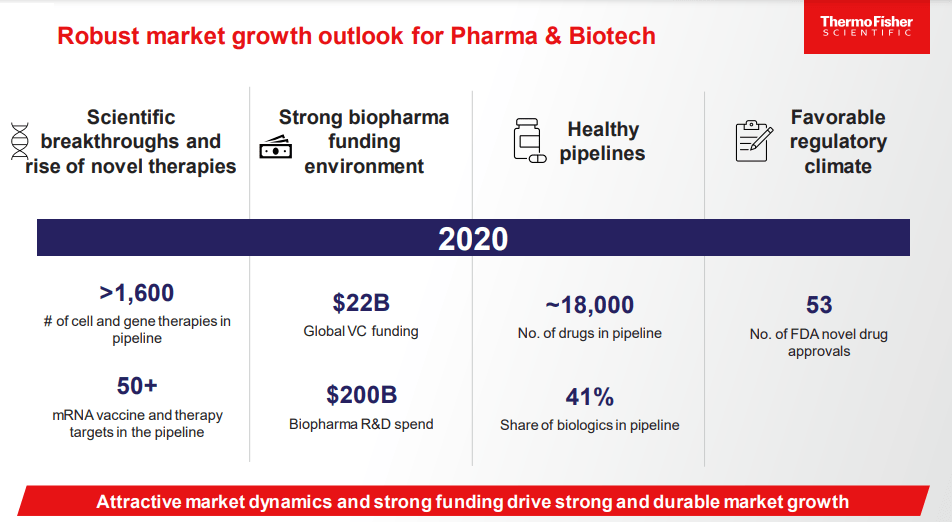

Thermo Fisher is valued as an industry leader and strategic partner in the pharma and biotech market. This market is forecasted to deliver long-term high-single digit growth. Biopharma R&D spending and the success of biologics (which exhibit higher costs of development) will be important drivers of growth. Biopharma R&D started the decade at $130 billion in annual spend, but that has risen at a 4% CAGR to $180 billion today. In addition, the cost of developing a drug has tripled over that same time period. The market is very attractive and supports Thermo Fisher’s strategic decision to increase exposure to pharma and biotech, which currently represents 39% of the revenue mix. When the PPD deal closes, pharma and biotech will represent more than half of the revenue mix (vs. 25% in 2012).

In biopharma, there are sub-segments growing significantly faster than the broader market (and creating new profit pools), like biologics, specifically in cell/gene therapy and mRNA. These platforms are fueling a robust pipeline of new drug development (as highlighted by Moderna and Pfizer/BioNTech Covid-19 mRNA vaccines). The global cell therapy market is estimated to grow at a ~60% compounded annual growth rate (CAGR) over the next several years to reach a total addressable market (TAM) of $12 billion by 2024 (from $1 billion in 2019). Further, the global gene therapy market is estimated to grow at a ~100% CAGR and reach a TAM of $13 billion by 2024 (from $400 million in 2019).

Thermo Fisher is highly leveraged to the success and rapid growth of new therapeutic platforms. As a trusted partner, Thermo Fisher will be supplying the “picks and shovels” to enable discovery and manufacturing.

Thermo Fisher’s fundamental outlook looks very promising. Longer-term, Thermo Fisher expects to deliver +7-9% core organic revenue growth—a full 200 basis points higher than the historical average organic growth rate. There could be additional upside to revenue growth from bolt-on M&A. In addition, Thermo Fisher expects to achieve 40-50 basis points of annual margin expansion, resulting in operating profit margins of over 26% (vs. 23.4% in 2019), and earnings per share (EPS) growth of +14-15%. Free cash flow is expected to grow at the same rate of earnings.

In our view, Thermo Fisher has greatly improved its long-term competitive positioning in the life science tools market despite an ongoing pandemic. We think Thermo Fisher will emerge from the pandemic as a faster-growing and more profitable company. Moreover, Thermo Fisher possesses the qualities of a competitive moat that is widening in the life science tools and diagnostics industry.

We continue to view Thermo Fisher Scientific as a core long-term holding in client portfolios.

Risks include: 1) reduced R&D investments by pharma and biotech companies, 2) reduced biomedical and public health research funding by government agencies, 3) slowing academic and biopharma demand, 4) deteriorating macroeconomic conditions, 5) changes in the regulatory environment, and 6) inability to integrate M&A or deploy capital.

Sources are available upon request.

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Christopher De Sousa, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.